Enhancing the value of payment data

We provide a marketing solutions platform to create value within the ecosystem gathering Banks, Consumers and Retailers.

N°1

banking cashback in France

data processed

of expenses categorized

What are our Beyond Banking Solutions ?

CDLK Banking suite : innovative solutions to meet different use cases for everyday banking

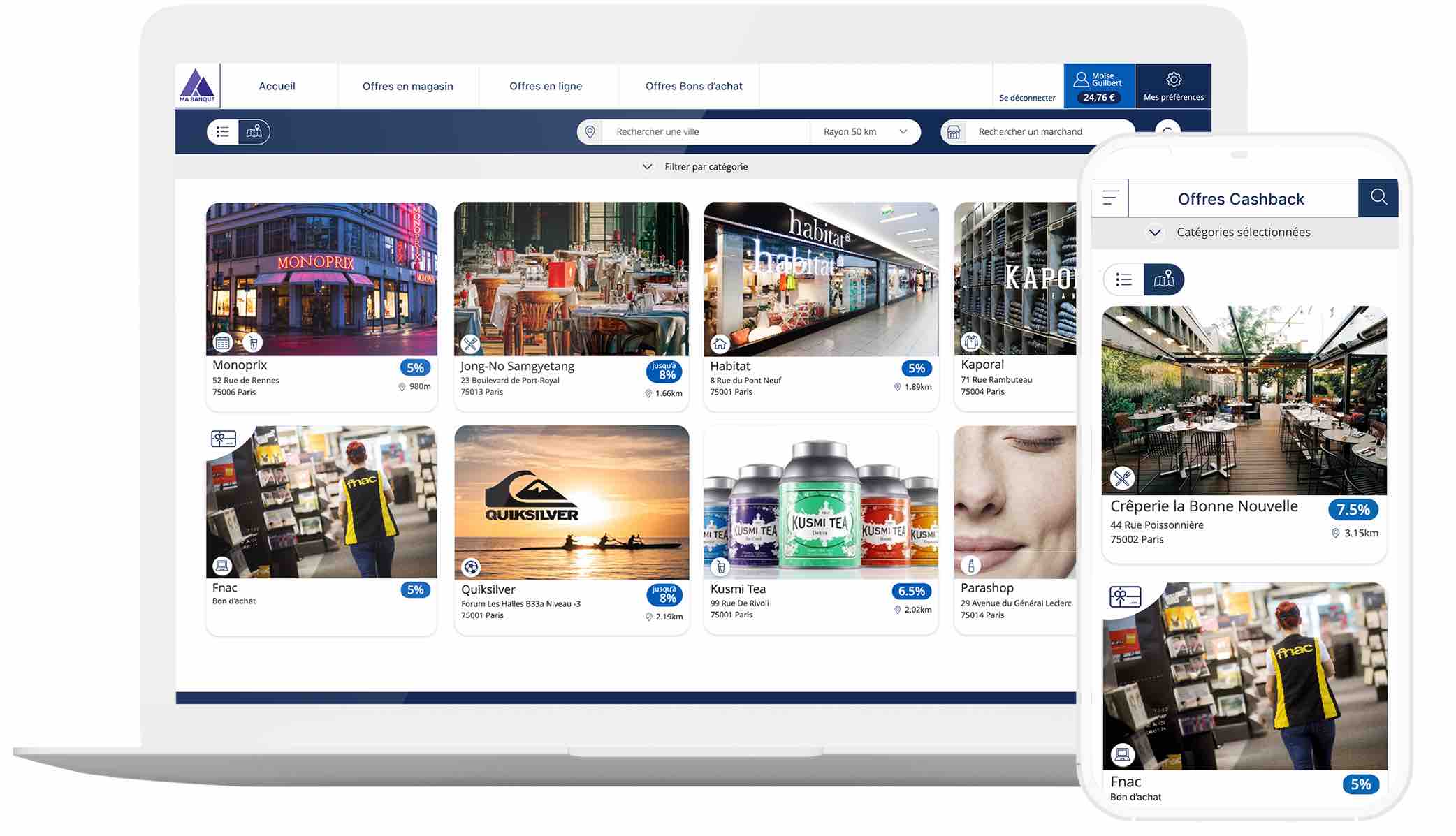

Cashback Program

CRM & Customer Insights

Improved Expense Statement

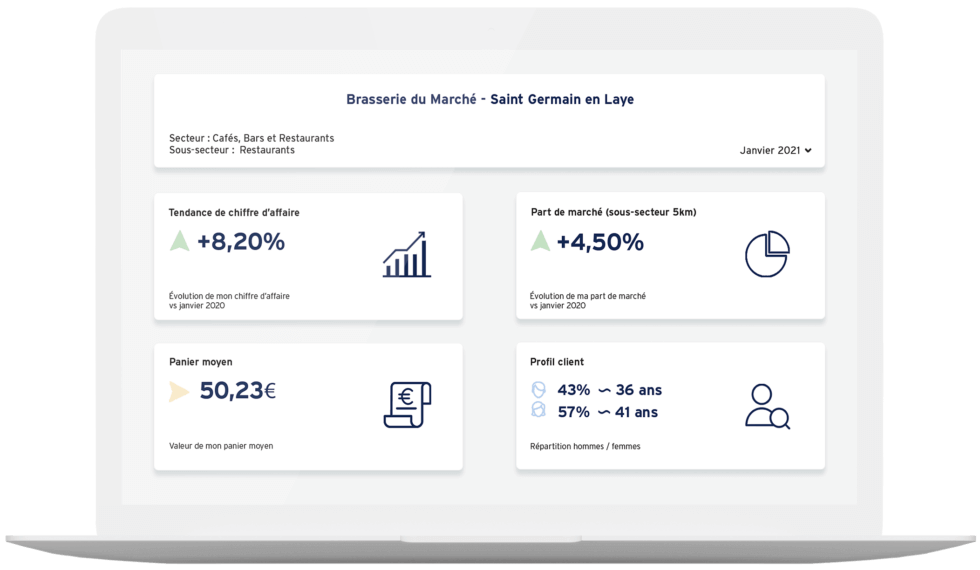

Merchant Report

![]()

A personalized and automated cashback loyalty program linked to purchases made by bank card at partner merchants.

The cashback offers are available in-stores, online and via vouchers.

![]()

A tool for enhancing and categorizing payment data based on consumption behavior, allowing banks to benefit from better customer insights.

![]()

Better readability of online account statements, with precise identification of expenses and points of sale, and 100% automated and reliable categorization of transactions.

![]()

Key performance indicators (KPIs) for banks’ business customers, with a benchmark view of their point of sale.

Key advantages of our solution

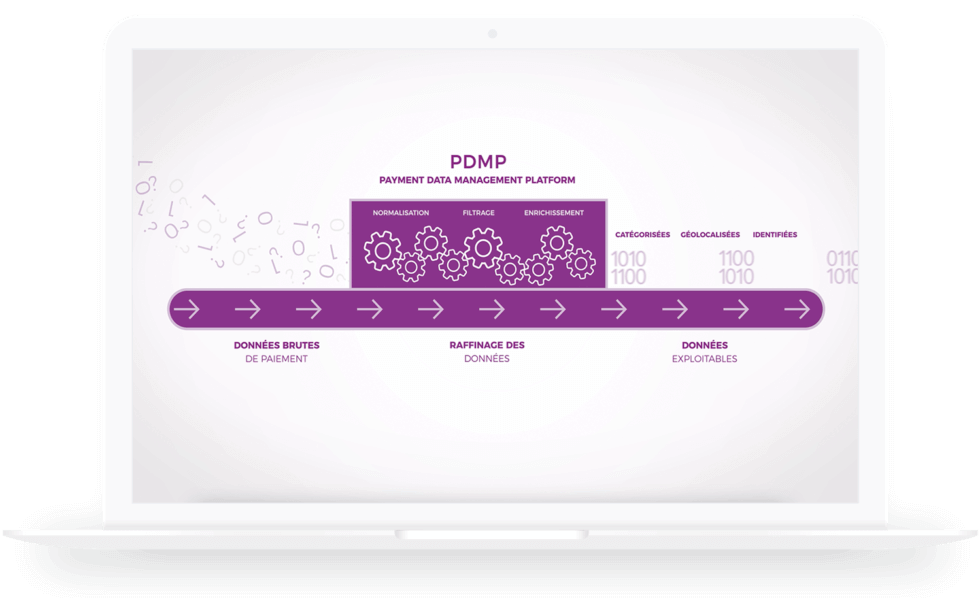

Data quality

A Big Data technology based on an innovative sourcing method from raw payment details.

Security & compliance

A secure and proven platform, processing anonymized data in compliance with banking standards.

Scalable & customizable

The CDLK solution is scalable and adaptable to meet the bank’s evolving needs.

Plug and play

We guarantee a quick installation of the solution at the bank, in either Saas or On-Premises mode.

Customer Stories

« The performance of CDLK’s CLO Platform allows us to keep up with our current membership base of several million cardholders who can access thousands of cashback offers daily. »

Caroline Arnould,

LCL CityStore Development Director

« To remain competitive in this dynamic market, we must constantly innovate to differenciate ourselves. And the contribution of a start-up like CDLK in this area of innovation is extremely valuable to us. »

SERGE HOVHANESSIAN,

Head of Banking Services

News

blog

Payment data, the banks’ trump card to counter the Tech giants

Opinion Column by Benoit Gruet, CEO & Co-Founder of CDLK, in the Journal du Net (French News website).

MAPPING

CDLK selected in the #Fintech100 ranking – 2022 Edition

Finance Innovation & Truffle Capital published the list of the 100 most innovative French Fintechs & Insurtechs

EVENT

Meet the CDLK team at the Fintech R:Evolution Event

The annual Fintech event will be held on 20 October on the roof of the Grande Arche in La Défense.